Pay Equity: How Data, Analytics, and Technology Can Help

Pay equality is a hot topic in business right now. After all, it has a significant influence on recruiting, keeping, and engaging people, which is more important than ever in a tight labor market. And, because pay and benefits are the single largest investment a firm makes, it’s critical to spend that money properly and equitably.

There are also several compliance rules. California has approved a pay transparency law, which includes a requirement that companies reveal compensation ranges on job advertisements, joining Colorado, Nevada, Maryland, Rhode Island, and Washington, as well as a number of localities, most notably New York City. California has also recently legislated pay data reporting to the state government, emphasizing the need for firms to exhibit equal pay practices. Meanwhile, high-profile lawsuits (which may cost firms millions of dollars) heighten HR departments’ desire for their employers to pay fairly.

Employers perceive the potential to use pay equity to build a more inclusive work environment, attract and retain workers, and identify more diverse applicants, in addition to compliance and risk mitigation.

Business Case for Pay Equity

Pay and incentives are critical issues that affect both employees and employers in different ways. One thing is certain: we have reached a point of no return in terms of pay fairness concerns, therefore the time to act is now.

Employees Seek Equitable Pay

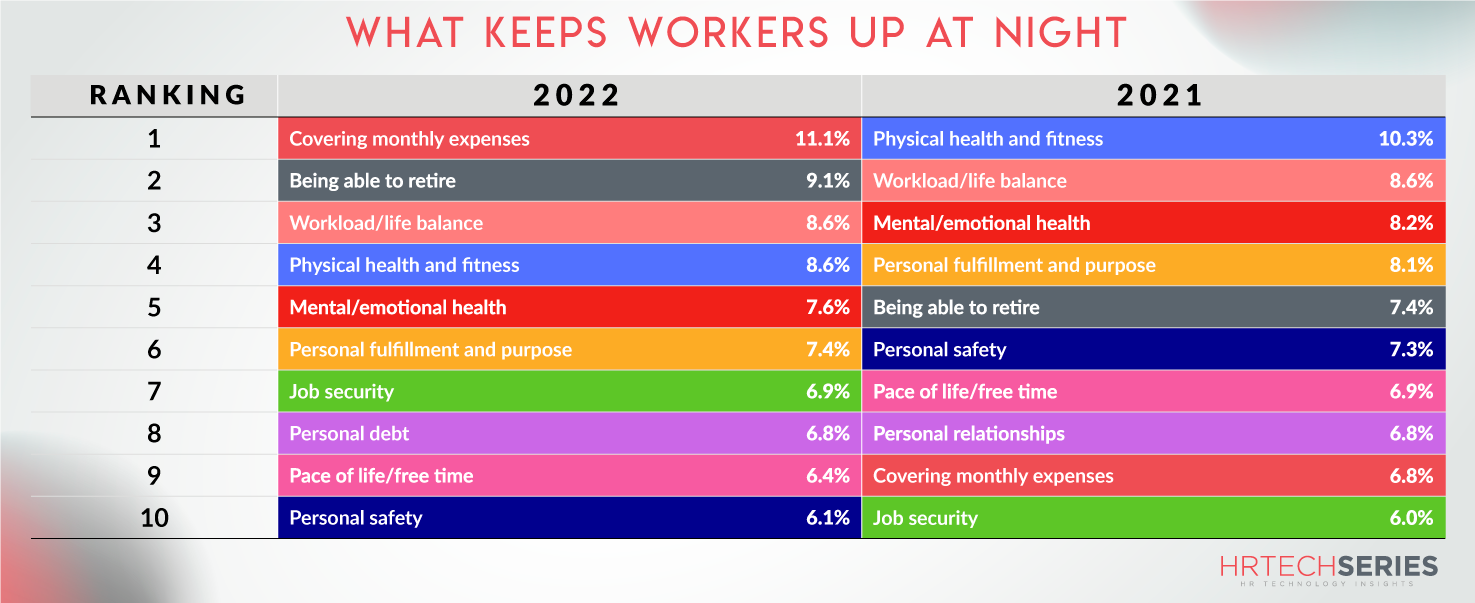

According to a recent Mercer poll of 4,500 workers’ attitudes, income has risen to the top of the list of factors influencing employee happiness at work. Three out of every four workers blame rising inflation and a volatile market for considerably increased financial stress, and despite growing concerns about job security, 36% are considering quitting their employment (up 8 points from last year). When questioned, “What keeps you up at night,” wage problems have surpassed physical health, work-life balance, and even mental and emotional wellness.

Pay and Rewards Now C-Suite Concerns

Making the right judgments for their businesses is difficult for the C-suite. Employees are reassessing their employment and professions as inflation rises and the labor market remains exceedingly tight. CEOs and CHROs must strike a balance between rising pay levels to support workers’ basic needs and diminishing earnings in the midst of a recession. And they are concerned about more than simply salary equity. Fair and equal compensation and awards are now expected, not just a nice-to-have.

Pay equality is a key concern for the C-suite, according to recent Trusaic research of the overall rewards plans of 448 companies, with 72% indicating it is an essential part of their people and business strategies.

The Effect of Pay Equity on Organizational Outcomes

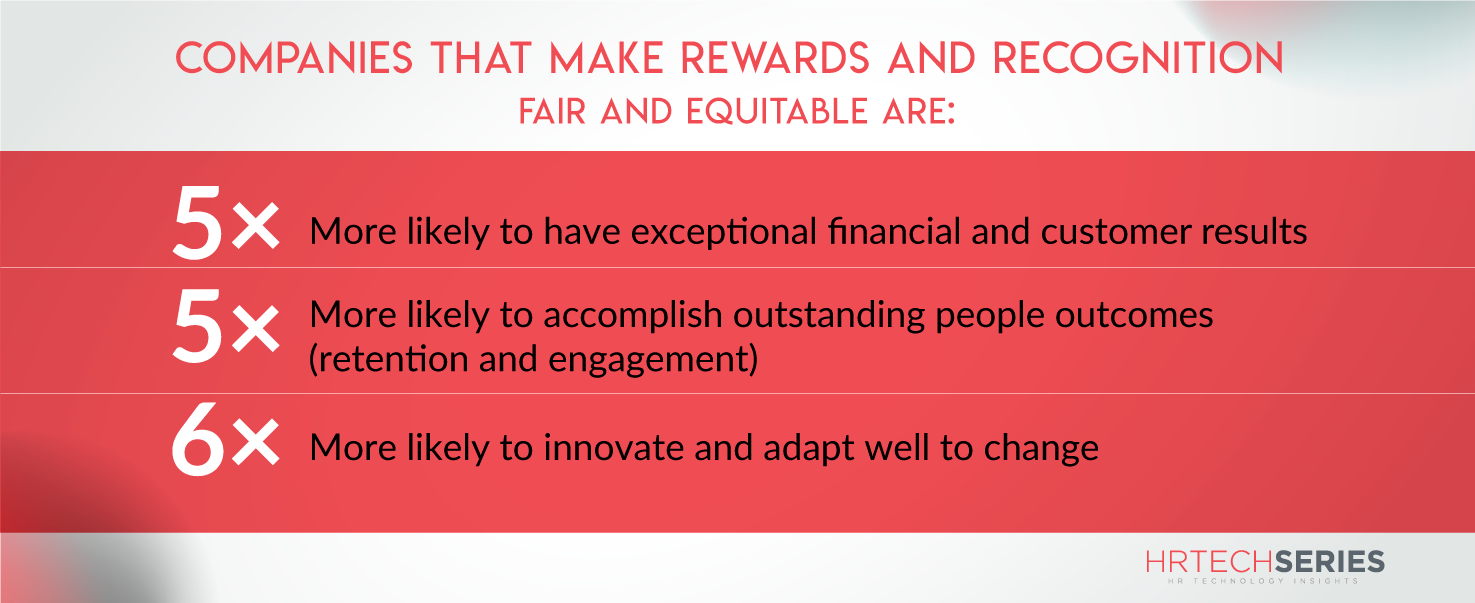

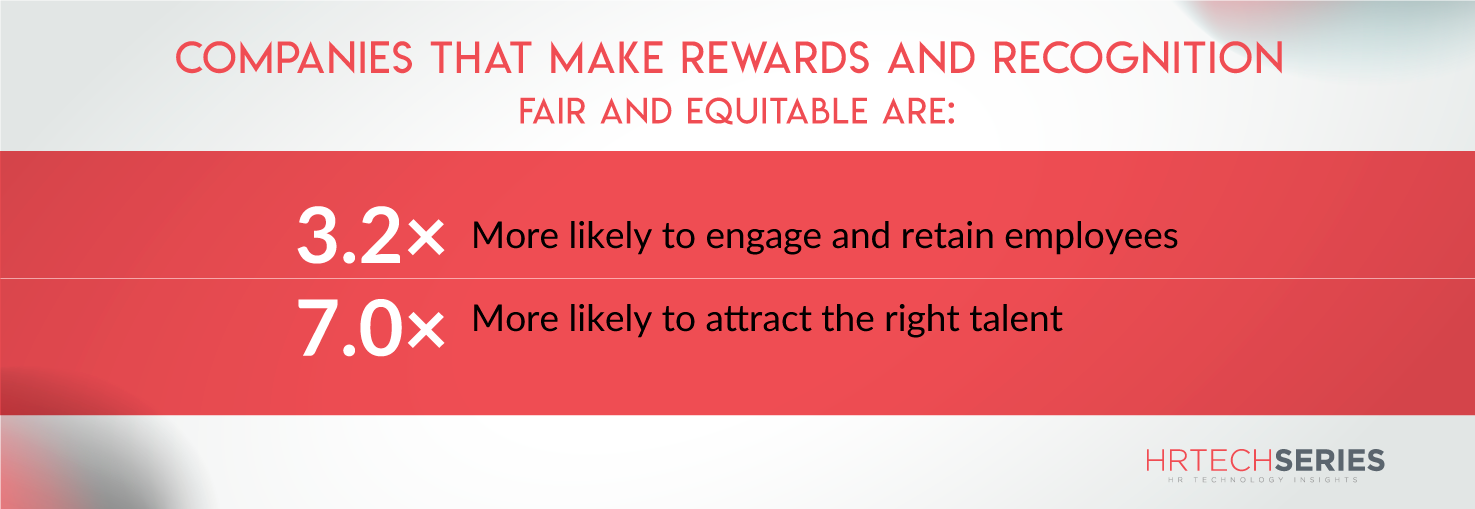

Aside from legal and compliance considerations and defensive risk avoidance, firms that focus on making incentives and recognition fair and equitable are bound to succeed in business: they retain and engage employees well, their customers are happy, and they innovate more. Simply defined, they are market leaders.

Trusaic’s research on a variety of issues demonstrates the broad influence of fair and equitable incentives on a variety of crucial outcomes.

Pay equity is associated with a better employee experience, a greater feeling of inclusion and more diverse teams, improved health and well-being, and more efficient use of limited total rewards investments. In terms of influence on results, pay equality practices consistently rank at the top of the list.

It also makes sense: when people believe their incentives and recognition are fair and equitable, they are more engaged; they join your organization; they stay longer; they feel welcomed; they are more creative; they are less anxious as a result, they are more productive and inventive, resulting in happy customers, financial growth, and innovation.

Based on a recent Pay and Rewards survey, 54% of employers perceive pay fairness as going beyond risk avoidance to achieve these more strategic aims. The benefits of executing this successfully are enormous, and if your company is like 58% of others, you have a C-suite leader eager to fund pay equity work.

Pay Equity: A Complex Subject

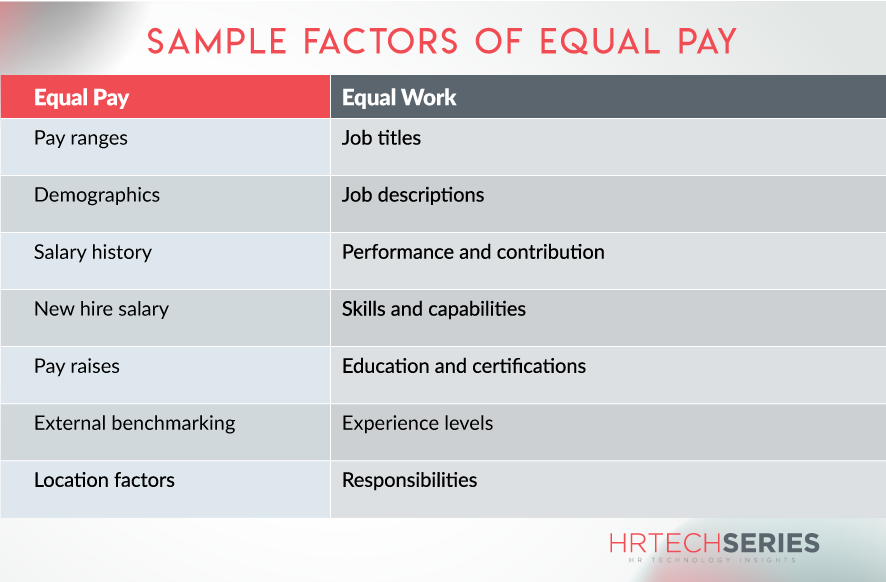

To begin, let us define pay equity. Our notion of pay fairness is straightforward: equal compensation for equal labor. There is a lot of intricacy and numerous aspects to consider behind this basic concept.

Pay fairness does not imply that all employees are paid the same. Rather than just comparing pay by gender or ethnicity, HR teams must decide which professions are substantially similar or comparable, divide them into “comparator groups,” and then use statistical methodologies to assess if pay levels are fair—or, in fact, biased.

So, how can you achieve wage equity? There are several components to it. From leadership to administration and effective communication. At the heart of it all: recognizing where the problems are so you can address them.

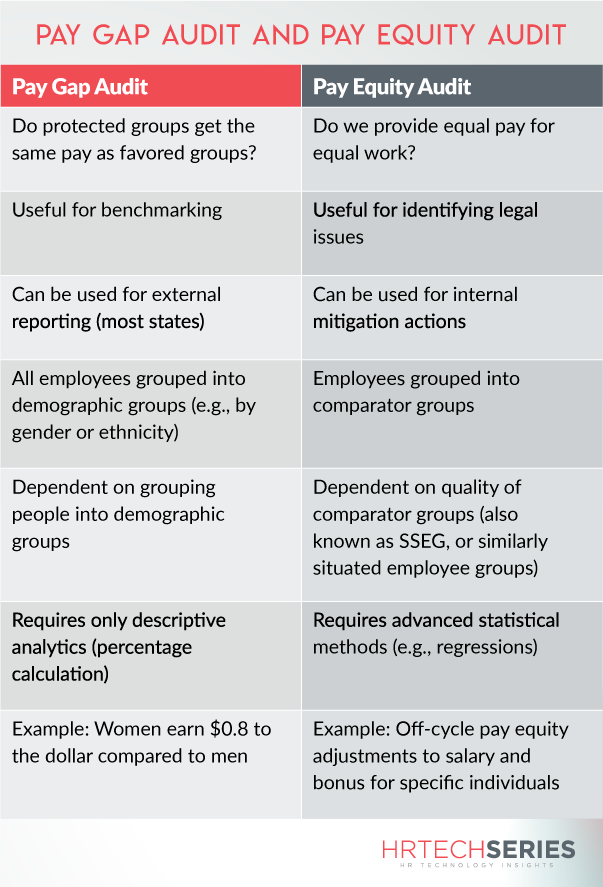

Pay Gap vs. Pay Equity

Data and analytics are used to identify pay equity concerns, quantify and prioritize gaps, determine mitigation strategies, and get ahead of the problem. It goes well beyond comparing women’s and men’s wages. Let’s distinguish between a pay gap audit and a pay equity audit.

While the pay gap audit is a basic calculation to obtain a pay ratio by demographic group, the pay equity audit is based on a range of data points (e.g., skills, job descriptions, experience levels, credentials, performance levels, and so on), needs knowledge of rules, and employs complex statistical methods to recommend specific steps to resolve pay disparities, which are pay inequalities after accounting for valid business variables, such as s A pay gap audit takes only basic demographic and pay data and exposes the raw pay disparity, but a pay equity audit delves into particular issues to find pay inequalities and locate solutions.

Three Ways to Conduct a Pay Equity Audit

There are three basic approaches to performing a pay equity audit:

- Do it yourself: Attempt to do your own pay equity audit within your business, utilizing spreadsheets or basic analytical tools.

- Legal or advisory assistance: Bring in a consulting and/or legal company on a regular basis to undertake a pay equity audit for you.

- Specialized software: Conduct the wage equity study using specialized software.

Most organizations are not qualified to handle this procedure in-house on a regular basis since it becomes difficult and time-consuming. According to the Pay and Rewards survey, 86% of employers do not use specialized technology or data analytics to uncover pay equity concerns, indicating that there is much room for improvement. It not only takes a long time, but there is also the risk of “doing it wrong,” with legal, regulatory, and reputational ramifications. And the broader payoff of getting it right—better workforce acquisition, retention, engagement, productivity, creativity, and diversity—is within reach when specialist technology and analytics are used.

To assist you in deciding which solution is best for you, we will first describe the process of a pay equity audit as well as the specific data, analytics, and statistical models that are necessary.

What is Pay Equity Audit

Employers must go beyond a pay gap audit and execute a pay equity audit to realize the benefits stated above.

But how exactly does it work? It’s an iterative, sophisticated process that starts with various data pieces from your human capital management (HCM) system and ends with a thorough action plan based on regressions and other statistical principles.

Step 1: Lay the groundwork

Before you can develop a model, you must first define the parameters for the analysis and then gather the relevant data.

Specifying the Scope

The scope of the study is the first stage in a pay equity audit. While you may be tempted to start with the entire corporation in order to gain traction quickly, it may be simpler to start with one location, business group, or functional area and then scale up.

Examining the Reward Strategy

Your compensation strategy is also important in this first phase. How much weight do you place on individual abilities, experiences, and performance? What compensation components comprise your overall incentive package? Do you pay differently depending on where you work? All of these issues must be addressed in the pay equity audit.

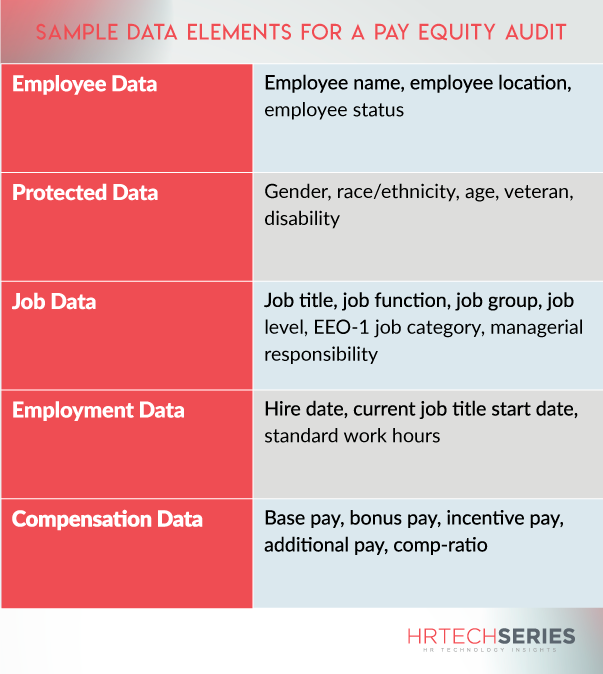

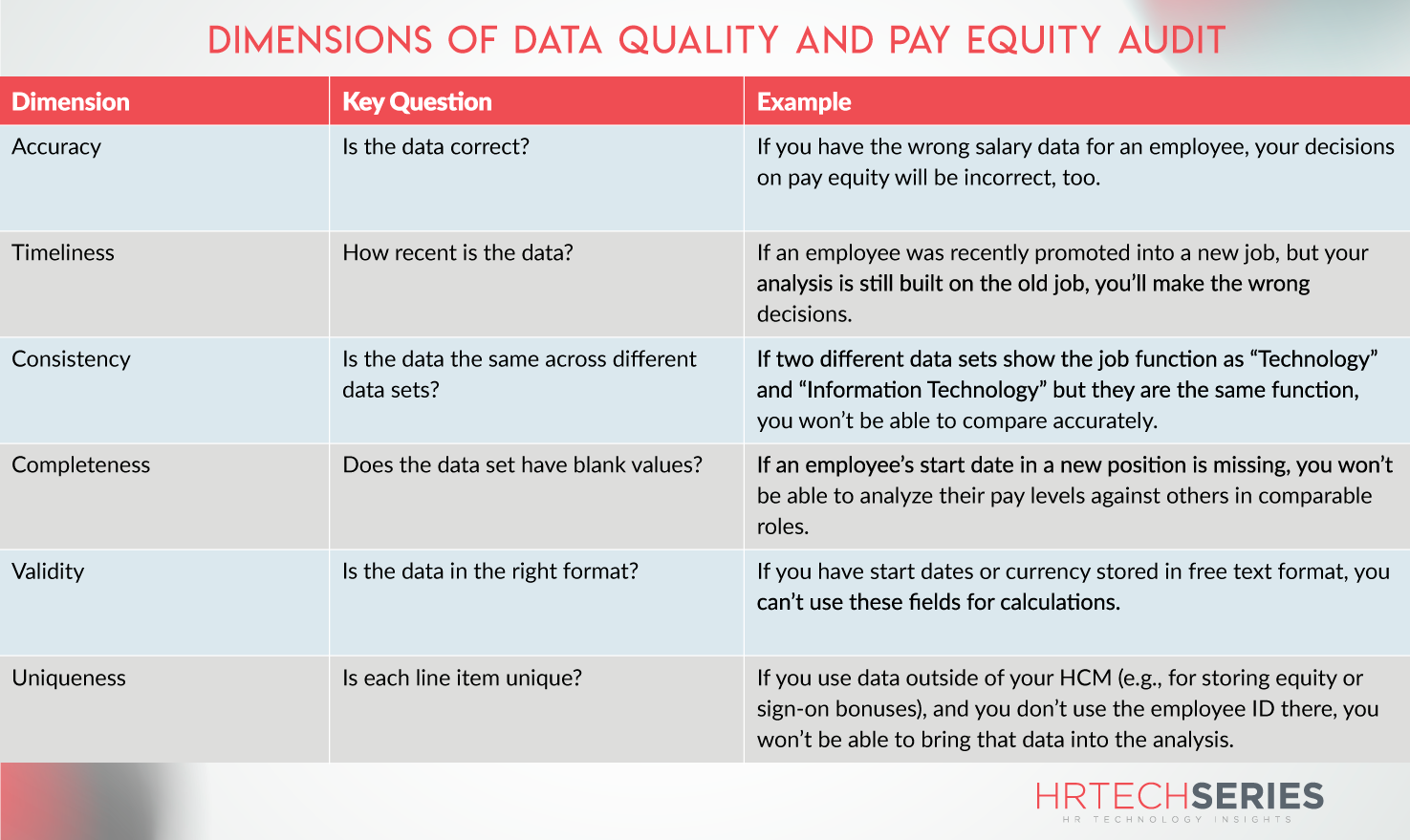

Gathering Data

Regardless of whether you do the pay equity audit in-house, you should consult with a consulting or legal firm, or hire a specialist technology business. The outcomes are based on gathering the necessary data and then executing the appropriate analysis.

The majority of these pieces are located in your HCM system, therefore having someone on the pay equity team who is familiar with this system and understands how to handle data issues is critical.

Step 2: Create the model

This phase creates an initial statistical model using the variables from Step 1.

Establishing Pay Analysis Group

Once you’ve gathered all of your data, you should create “pay analysis groups,” or comparator groups. Typically, these groups are more than just job categories or work tasks. They are instead higher-level groups that apply statistical modifications to compare various placements. Statistical adjustments, for example, might enable comparisons between project managers in IT and project managers in HR, as well as between a director in marketing and a director in finance. The measurement of any systematic pay discrepancies based on protected groups takes place inside a pay analysis group.

On the other hand, pay analysis groups to preserve differences across workforce sectors that adhere to different compensation philosophies. To ensure that the categorization is neither too granular nor too wide, HR must collaborate with the business team to select these comparator groupings.

Choosing Wage Influencing Variables

Compensation disparities might arise for valid reasons—actual business variables influencing pay. For example, shift differential compensation may apply in retail businesses where employees are paid more for working at night. Similarly, differing skill levels, levels of experience, or levels of performance are all reasonable business justifications for compensation disparities.

Performing Regression Analysis

You can establish if apparent gender and racial pay inequalities exist for reasons other than valid business considerations by doing a regression analysis on each pay analysis group.

Pay disparities that vary systematically with protected class differences may pose legal risks or responsibilities. The findings of the pay equality audit allow you to examine each of these disparities from a variety of perspectives, such as statistical significance, implications for overall yearly compensation in the workforce, individual employees, and a variety of intermediate levels.

Step 3: Test the model

Checking and executing the model is an incremental method since the initial study must be revised and updated for the addition of previously ignored wage-influencing factors as well as the removal of wage-influencing elements that do not explain pay discrepancies.

Examining the Initial Mode Outcomes

Examining the sensitivity of class differences to the addition and absence of various wage-influencing elements is one technique to evaluate the basic model. Another is to investigate the sensitivity of class differences to employee inclusion and exclusion. A third goal is to look at how measured class discrepancies match up with supervisors’ class identifications. Such comparisons help evaluate how well the model is doing and also point out areas for improvement.

Rerunning and Updating the Model

Given the intricacy of the data and the analysis required, you will most likely need to add more parameters and repeat the model several times.

After a few runs through the model, you’ll have an analysis that is both accurate and valuable for identifying protected-class and employee-level concerns.

Step 4: Make a plan to address the symptoms and tackle the root cause

Employee Compensation Modification

The most urgent step is to give salary adjustments to employees who are being paid unfairly. Companies use many ways to do this, ranging from including it in the yearly remuneration process to making one-time changes staggered across time, or a combination of the two. Many businesses also use external compensation standards when determining the importance and timing of modifications.

Identifying Root Causes and Making Policy Changes

In case of employee challenges, it is critical to consider the larger picture. Is there anything in common among those most affected by wage disparity? How do discrepancies change through time, place, and organizational level? The pay equity audit helps you find causes, not just symptoms, by having you answer these questions.

Reviewing and changing rules is critical for staying ahead of difficulties. To eliminate disparities in promotions, a retail corporation, for example, implemented more demanding training and certification criteria for its promotion process. Other rules might include stricter limits on new hire compensation and sign-on incentives, reducing disparities between longtime staff and outside applicants.

Step 5: Observe and improve

If compensation changes have been made, you can follow progress with continued monitoring.

Refreshing Data Periodically

Continuous pay equality monitoring decreases the risk of having to address the same issues over and over, and it also assists you in identifying changes in your workforce that might affect gender and racial pay discrepancies.

Estimating Equal Pay Problems

Estimate any potential problems ahead of time. These could be related to hiring (particularly in a climate of rapidly rising starting salaries), “boomerang” employees (paying returning employees more than those who never left), or promotions (for example, if promotions are not linked to specific criteria and are at the sole discretion of the line manager).

Using Market Compensation Data to Determine Fair Salary Ranges

Take the pay equity audit results and market comp data to determine the “fair pay range.” The data are then used by recruiters and managers to propose competitive and fair compensation that does not create new pay inequality in the future.

Options for Pay Equity Solutions

When considering the many possibilities for your pay equality study (and when reviewing individual providers), there are several elements to consider, ranging from legal considerations to process efficiency, platform ease of use, analysis quality, and insights acquired to solve pay equity challenges.

Balancing these factors and identifying what is most essential for your business can assist you in finding a solution that works for you today and in the future.

Conclusion

Providing equal remuneration, pay, prizes, and recognition is not just the right thing to do; it is also excellent for business, assisting you in attracting and retaining the talent you require in a difficult labor market, resulting in happier consumers, financial success, and more inventive offers.

Making pay and rewards equal is a process, not a destination, just as improving employee experience, diversity, equity, and inclusion is never finished. This expedition requires specialized technologies and in-depth analyses.

Pay and benefits are gradually becoming the greatest percentage of your expenditure as every corporation becomes a service company. However, instead of viewing it as a cost, consider it an investment in the people that power your organization. Data, analytics, and specialist technology are critical to assisting you in prioritizing those expenditures so that you may completely enjoy the rewards, making your firm desirable.